2 MB

Key takeaways

- Tensions over the Panama Canal are intensifying as the U.S. and China escalate their competition for control over critical global infrastructure, positioning Panama at the center of a growing geostrategic confrontation.

- The return of the Trump administration in early 2025 marked a shift in U.S. policy, with Washington pressuring Panama to sever ties with China’s Belt and Road Initiative (BRI)—a demand Panama fulfilled, becoming the first Latin American country to exit the scheme.

- In parallel, a U.S.-led consortium led by BlackRock acquired an 80% stake in Hutchison Port Holdings, which operated key canal ports under Chinese management. The $22.8 billion deal is viewed as a landmark move to restore U.S. influence over maritime logistics hubs.

- China, however, continues to pursue a long-term regional strategy combining infrastructure investment (e.g., Amador Cruise Terminal, LNG port plans), soft power (Confucius Institute), and high-level diplomacy, underlining its intent to maintain strategic access in Latin America.

- Despite these efforts, Chinese investments in Panama are losing momentum amid rising local resistance and U.S. counterpressure, illustrated by the collapse of port projects and the devaluation of CK Hutchison’s stock following the BlackRock deal.

- Panama now faces a strategic dilemma between U.S. security guarantees and Chinese financial engagement. The deepening U.S.-Panama military cooperation and China’s regional recalibration signal a larger contest over control of chokepoints in an increasingly fragmented global order.

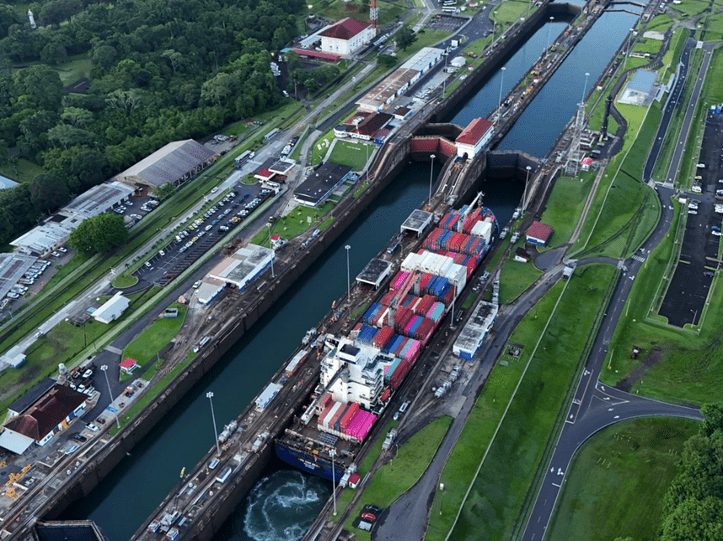

The Panama Canal remains a vital geostrategic chokepoint today, at the center of intensifying rivalry between the United States and China. Its importance extends beyond the economic and strategic domain, encompassing security and geopolitical dimensions, making it a focal point of both countries’ attention. The Canal is a critical component of global infrastructure, facilitating the transit of more than 5–6% of the world’s maritime trade.

The Canal’s strategic value in global commerce increased significantly in 2016, when its expansion enabled the passage of larger vessels, specifically Neopanamax ships. The Canal remains essential to global trade routes by linking the Atlantic and Pacific Oceans, especially for industrial and raw materials shipping. Although control of the Panama Canal was officially transferred to Panama in 1999 under the Torrijos-Carter Treaties, the United States remains its principal user. Over 40% of U.S. container traffic passes through the Canal annually, and approximately 70% of goods transported via the Canal either originate from or are destined for American ports.

Escalation of Geopolitical Tensions Around the Panama Canal

The return of the Trump administration to power in the United States has had a visible impact on Panama’s foreign policy trajectory. In early January 2025, President Trump declared that China “controls” the Panama Canal and that the United States must “take it back.” This rhetoric reflects growing strategic friction in the region.

In recent years, China has intensified efforts to solidify its presence in Latin America, particularly through its Belt and Road Initiative (BRI), which includes substantial regional investments. Beijing’s assertive approach has fueled concerns about Chinese expansion in Latin America and its potential long-term strategic consequences. In response, the United States has ramped up diplomatic engagement to reinforce its position in Panama and counter Chinese influence. In 2025, the newly appointed U.S. Ambassador to Panama, Kevin Cabrera, outlined the administration’s priorities in the region: deepening ties with Panama and pushing back against malign Chinese influence. This statement marked an explicit escalation of U.S.-China rivalry in the country.

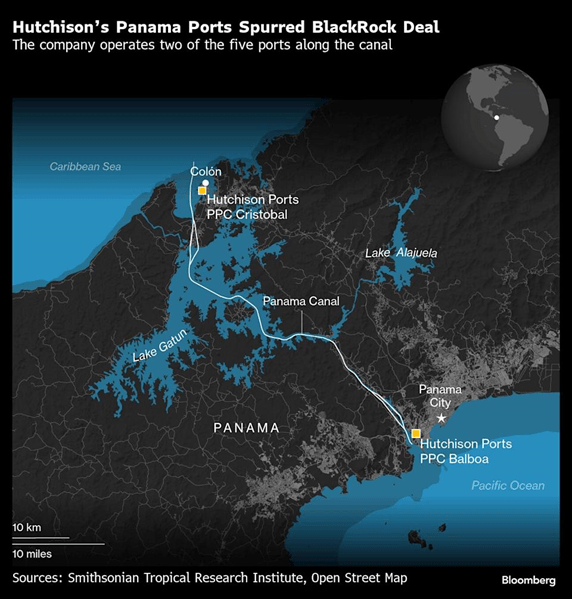

Tensions further rose following blunt remarks by U.S. Secretary of Defense Pete Hegseth, who warned of the Chinese threat to the Panama Canal, referring to the ports of Balboa and Cristóbal, located at either end of the canal and managed by a Hong Kong-based consortium. These remarks were met with strong criticism from the Chinese government.

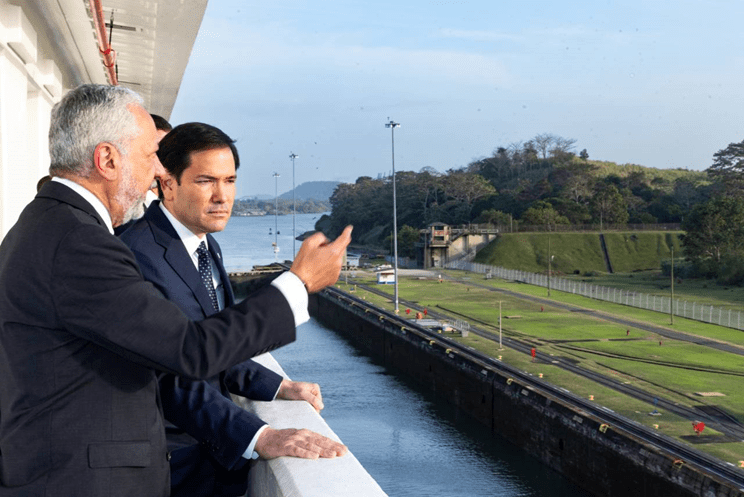

Following Trump’s statements and a visit to Panama by Secretary of State Marco Rubio, who urged Panamanian authorities to reevaluate ties with China, Panama soon announced its decision not to renew its memorandum of understanding regarding China’s BRI. This move was widely seen as a response to growing geopolitical pressure from Washington and reflects a strategic shift in Panama’s foreign policy alignment. Panama’s decision to exit the BRI underscores the country’s limited autonomy in geostrategically contested regions amid great power competition.

As part of the U.S. effort to reassert influence over the Panama Canal, in March 2025, the American investment firm BlackRock, in partnership with a consortium of other investors, announced the acquisition of an 80% stake in Hutchison Port Holdings. This Hong Kong-based company operates the Balboa and Cristóbal ports. Trump hailed the $22.8 billion deal as a “landmark agreement that gives the American consortium control over the keys to the Panama Canal and removes it from Chinese hands.” The acquisition represents a significant economic lever of U.S. geopolitical influence, aimed at displacing China from this critical logistics hub, and illustrates the use of financial instruments as part of a broader regional dominance strategy.

Panama’s foreign policy shift following Trump’s return to office exemplifies the United States’ use of economic levers to reclaim its regional influence. Panama, the first Latin American country to join the BRI, also became the first to officially exit the initiative—an act that signals a reappraisal of its strategic priorities. This maneuver could also reflect a response to the declining momentum of the BRI, marked by a reduction in regional projects and waning Chinese financial commitments.

However, Washington’s assertiveness in the region has met with mixed reactions. During a visit to China in May 2025, Brazilian President Luiz Inácio Lula da Silva reaffirmed his country’s commitment to deepening economic ties with Beijing. Colombia, despite its historical alignment with Washington, has also opted to deepen ties with China by joining the BRI. U.S. actions are increasingly perceived as a revival of “big stick” diplomacy, prompting many Latin American nations to strengthen their engagement with Beijing.

China’s Strategy in Panama

China has methodically expanded its presence in Panama since the launch of the Belt and Road Initiative (BRI) in 2017. This expansion is characterized by substantial investments, major infrastructure projects, and strategic diplomatic efforts. In 2023, Chinese investments in Panama reached $1.4 billion, representing a fourfold increase compared to the beginning of the BRI, while U.S. investments, although historically higher, declined over the same period.

Smithsonian Tropical Research Institute, Open Street

Map/Bloomberg

While the United States remains Panama’s principal investor and the dominant user of the Panama Canal, Beijing’s influence on infrastructure development has become increasingly significant. Evidence indicates that China’s infrastructure investments aim to address strategic gaps left by the United States in the region. One flagship project exemplifying this approach is the Amador Cruise Terminal, constructed by China Harbour Engineering Co. Ltd. on Perico Island near the Pacific entrance to the Panama Canal, which officially opened in March 2024.

China’s proposed infrastructure initiatives in the Panama Canal region include the construction of a container port in the Colón area capable of handling liquefied natural gas, the development of a 400-kilometer railway line connecting Panama City with Chiriquí Province, and a 250-mile high-speed rail link from Panama City to the western border with Costa Rica.

Despite encountering local opposition and geopolitical pressure from the United States, China has secured significant progress in implementing these projects. As of 2024, according to data from the China Development Bank, China has extended approximately $160 billion in financial support across more than 250 projects in 21 Latin American countries, substantially contributing to their economic and social development. This pragmatic cooperation spans energy, mining, manufacturing, electricity generation, and telecommunications sectors.

A critical diplomatic milestone occurred in 2017, when Panama formally severed diplomatic ties with Taiwan—a self-governing island claimed by China—and strengthened relations with Beijing. China has since actively fostered diplomatic engagement with Panama by organizing forums and summits involving leaders from Latin America and the Caribbean to enhance cooperation and advance the BRI. Key initiatives include the China-CELAC Forum and establishing the China-Latin America and Caribbean Cooperation Fund.

Moreover, China has increased its soft power presence by establishing a Confucius Institute in Panama to promote the Chinese language and culture, alongside humanitarian gestures such as donating medical supplies during the COVID-19 pandemic. These social and humanitarian initiatives have been central to China’s strategy to consolidate diplomatic influence in the region.

Thus, amid intensifying geopolitical rivalry and Washington’s growing determination to displace China from the Latin American landscape, Beijing has implemented a systematic strategy to consolidate its foothold in Panama by leveraging financial instruments, large-scale infrastructure initiatives, and diplomatic tools of influence. In this context, China’s approach has been rooted in addressing institutional voids left unfilled by the United States. Its presence, manifested through humanitarian initiatives and sustained economic engagement, has elevated Beijing to a visible and influential actor within the strategic landscape of the Panama Canal. This, in turn, has compelled Washington to thoroughly reassess its policy in response to China’s expanding footprint in the maritime gateway.

Panama Under U.S. Pressure: A Shift in Political Course

China’s growing influence in the Panamanian region has intensified American pressure to distance the country from Beijing. Following the departure of Panama’s former leader, Juan Carlos Varela, his successor, Laurentino Cortizo, halted the proposed railway project. Trade negotiations reached an impasse. In 2021, the Panamanian government revoked Landbridge’s rights to the container port project after an audit revealed that the company had violated contract terms by underinvesting and hiring fewer local workers than promised. These developments predictably cast doubt on the reliability and efficacy of Chinese investments.

Economic considerations and disappointment with Chinese projects led to the termination of the key partnership between Panama and the Belt and Road Initiative (BRI), provoking strong criticism from Chinese officials. A spokesperson for China’s Ministry of Foreign Affairs described this move as a coercive tactic by the United States designed to discredit and undermine cooperation under the BRI framework. The official emphasized that Panama should consider the broader scope of China-Panama relations and resist external interference.

However, the agreement with BlackRock, granting the American financial consortium access to port infrastructure, was a pivotal point in Panama’s strategic reorientation. This move not only curtailed China’s economic maneuvering space but also prompted a reconsideration of the control architecture over supply chains in the Central American region.

Consequently, the winding down of China’s infrastructural initiatives and suspension of large-scale projects deprived Beijing of critical leverage tools. For the U.S., it represented a timely opportunity to propose an alternative—a more reliable and strategically motivated form of cooperation embodied in the BlackRock agreement. This deal signaled a change in Panama’s foreign orientation and marked a new phase in the contest for dominance over a vital logistical artery.

A separate dimension of Sino-American tensions involves former President Trump’s declarations about “returning” control of the Panama Canal to the United States and countering Chinese attempts to manage and exploit the maritime hub. The potential use of military force to achieve this goal, including redeploying American troops to Panama to secure the strategically crucial canal, was also hinted at. This rhetoric reflects a radicalization of the U.S. foreign policy stance in response to China’s rising influence. It forms part of a broader strategy aimed at reasserting American hegemony in regions traditionally considered within its sphere of influence.

Panamanian President José Raúl Mulino rejected Trump’s assertions, underscoring Panama’s sovereignty over the canal. The Panamanian government appealed to the United Nations, expressing concern that Trump’s rhetoric violated the UN Charter’s principles. Beyond the overall atmosphere of confrontation and regional polarization, Panama now faces a strategic loyalty dilemma between the two global powers.

China’s response to Trump’s accusations came from the Minister of Foreign Affairs, who affirmed that China has never participated in the management or operation of the canal, respects Panama’s sovereignty, and recognizes the canal as a permanently neutral international waterway. Chinese officials labeled Trump’s statements as provocative, baseless, and reminiscent of Cold War mentalities. In March 2025, the Chinese state media outlet Ta Kung Pao published a series of harsh articles condemning CK Hutchison Holdings amid its plans to sell Panamanian port assets to the American-led BlackRock consortium. Republishing these articles on official portals of China’s Hong Kong and Macao Affairs Office underscored Beijing’s discontent.

The repercussions of such rhetoric extended far beyond mere political reactions. In particular, Washington’s hardline stance and Panama’s subsequent actions inflicted significant economic losses on the Chinese side, most notably reflected in the plummeting stock value of CK Hutchison, the firm managing key port facilities near the canal. CK Hutchison Holdings’ agreement to sell its controlling stake in Panama’s port assets to a consortium led by BlackRock triggered an unprecedented market response, with shares of the Hong Kong-based company dropping by 6.7% in a single day—the steepest decline in five years. This sharp sell-off and market crash underscored the company’s entanglement in the escalating geopolitical standoff between the United States and China. The sale of port assets under mounting geopolitical pressure further eroded confidence in Chinese investments’ long-term viability and stability across Latin America.

The BlackRock deal, concluded in the wake of Trump’s contentious statements, can be seen as a direct repercussion of such rhetoric and a geo-economic instrument of American influence. Although CK Hutchison denied any political pressure as a motivating factor, framing the transaction as purely commercial, the timing of the agreement coincides with heightened U.S. pressure and efforts to curtail China’s presence in a strategically vital region. Thus, the deal can be interpreted not merely as a financial transaction, but as a form of political declaration—signaling the reassertion of American control over critical logistical assets near the Panama Canal.

Strategically, the United States effectively re-internalized infrastructure that had fallen under Chinese influence, leveraging the private sector as a vehicle for advancing its geopolitical agenda.

Ongoing Power Struggles and Panama’s Strategic Dilemma

In April 2025, the United States and Panama signed a security cooperation agreement granting U.S. military personnel access to select Panamanian facilities. The move sparked a wave of protests across the country, as Panamanians voiced their opposition to deeper military collaboration through large-scale demonstrations in the capital.

These reactions were partly driven by historical resentment, particularly the collective memory of the 1989 U.S. invasion that ousted the Noriega regime, which left a lasting imprint and fostered enduring mistrust of American military presence. Protesters expressed concerns that such enhanced cooperation might undermine Panama’s sovereignty, raising fears of undue foreign interference.

On a broader scale, the agreement can be interpreted as a step toward constructing a new security architecture in Central America. It also sends a clear message to Beijing, signaling Washington’s willingness to reinforce its economic footprint with a military-strategic presence.

Consequently, the regional balance of power is shifting unfavorably for China: U.S. containment of Beijing’s expansion is intensifying, and the Panamanian-U.S. partnership may lay the groundwork for new regional alliances.

However, it is premature to declare a full resurgence of U.S. influence in Latin America. Washington’s actions, particularly its reliance on the private sector and emphasis on security partnerships without overt military deployment, point to a gradual, hybrid approach. While these measures lack a formal political framework, they are unmistakably embedded within the broader context of strategic U.S.-China rivalry. One could argue that this is a diplomatically veiled restoration of U.S. influence, structured around the triad of finance, politics, and defense.

Trump’s rhetoric underscores a persistent ambition to reassert U.S. dominance in the region—an approach that prompted China to urge CK Hutchison to reconsider its position on selling its controlling stake to American investors. Despite Beijing’s restrained diplomatic tone, the warning reflects deep unease and a clear unwillingness to allow the regional balance to tilt further away from Chinese interests.

Conclusion

As anticipated, the Panama Canal, as a critical maritime chokepoint, will assume heightened geopolitical significance and become a focal point of friction between the United States and China. The renewed assertion of American “dominance” was set in motion by the BlackRock deal and the strengthening of military-political cooperation between Panama and the U.S. However, Washington does not intend to act in an overtly radical manner, opting instead for flexible strategies that include economic infiltration through private entities and political rhetoric devoid of formal doctrines.

Accordingly, China will be compelled to reassess its investment strategies in Latin America, though it is unlikely to cease its financial operations. The drop in CK Hutchison’s stock value and the political reverberations surrounding the BlackRock deal, which, tacitly accepted, is widely seen as a manifestation of U.S. political pressure, force Beijing to acknowledge the limitations of its influence in the region. For China, this underscores the necessity of bolstering its presence through economic, humanitarian, educational, and cultural initiatives.

This situation creates a long-term strategic dilemma of loyalty for Panama. Caught between intensifying pressure from both powers, the country will strive to balance political neutrality with economic dependency. Partnership with the United States offers a pathway to large-scale investments, projects, and security guarantees. Meanwhile, ties with China provide a reliable financial lifeline that remains one of the region’s most significant.

Thus, the rivalry between Washington and Beijing in Panama emerges as a protracted contest for normative control and institutional presence. It shapes a new geostrategic reality where control over a critical logistical hub signifies not only economic prestige but also a strategic advantage in the global balance of power.

Disclaimer: The views, thoughts, and opinions expressed in the papers published on this site belong solely to the authors and not necessarily to the Transatlantic Dialogue Center, its committees, or its affiliated organizations. The papers are intended to stimulate dialogue and discussion and do not represent official policy positions of the Transatlantic Dialogue Center or any other organizations with which the authors may be associated.

This publication was compiled with the support of the International Renaissance Foundation. It’s content is the exclusive responsibility of the authors and does not necessarily reflect the views of the International Renaissance Foundation.