375 KB

The world has already introduced seven packages of sanctions, but Russia finds a way around each of them: by itself or with the help of allied countries. Thus, the terrorist country continues to import goods, export energy carriers, which are subject to sanctions and which the world must abandon.

One of the countries with which Russia continues to deepen economic ties even in the face of sanctions is China, which today remains Moscow’s main trading partner. In this sense, Lavrov announced the emergence of a “new world order.” “We, together with you and our supporters, will move towards a multipolar, just and democratic world order,” the minister said before meeting with his Chinese counterpart, Wang Yi.

Sergey Lavrov, July 7, 2022. Source: Ministry

of Foreign Affairs of the People`s Republic of

China

Beijing, which refuses to call the Russian attack an “invasion” or a “war” and maintains a position of neutrality, has consistently voiced its opposition to the sanctions, which it considers “illegal”. China’s leadership has repeatedly condemned the sanctions, saying the measures will harm the world’s recovery from the COVID-19 pandemic and have a negative impact on global supply chains, energy and transportation, among other sectors. Chinese representatives have also repeatedly emphasized that “China is not a party to this crisis and does not want to be further affected by sanctions. China has the right to protect its legitimate interests and rights.”

Interestingly, China not only has not supported the sanctions against Russia, but also secretly helps the aggressor country to circumvent them.

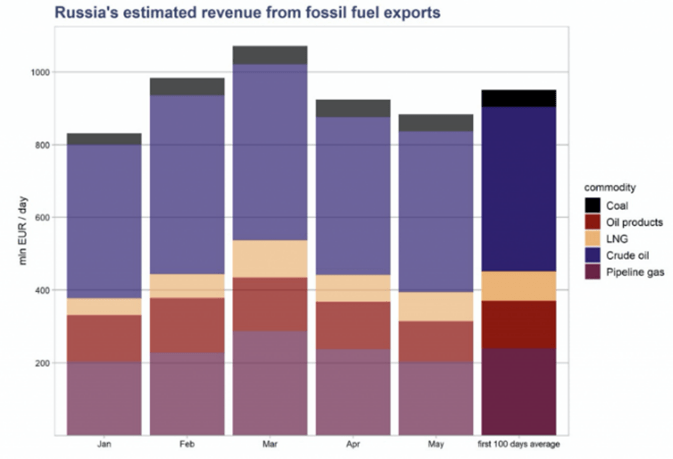

El sale of energy resources is the main source of funding for the Russian army and the engine of criminal aggression against Ukraine. According to CREA (Centre for Research on Energy and Clean Air), during the first 100 days of the war, Russia received 93 billion euros in revenue from the export of fossil fuels. China became the main importer during this period (12.6 billion euros).

Most of the imports from Russia to China are oil, natural gas and coal. China also receives Russian copper and copper ore, wood, and fuel. That is, Russia is becoming a kind of raw material appendage of China.

Despite sanctions on the import and transportation of crude oil and certain oil products from Russia, sales of these goods have only increased. In some cases, to the maximum values for all years. One of the legal loopholes for Russia is the export of oil to third countries, such as China, its further processing in order to be able to send this oil product to European countries.

Siberia», near the border

with China, which buys gas

at discounted prices. Source:

Getty Images

According to China’s General Administration of Customs, imports of Russian crude oil, including shipments via the East Siberia-Pacific Ocean pipeline, reached 8.42 million tons in May. This represents an increase of 55%, which reached a record level compared to last year. Also in recent months, Chinese state-owned companies such as Sinopec and Zhenhua Oil have increased their purchases of crude oil. Thus, Russia took first place in the supply of raw materials to the People’s Republic of China, ahead of Saudi Arabia.

Due to the threat of possible sanctions or damage to the reputation, most importers of liquefied gas around the world have refused to buy Russian cargo, but Chinese firms are becoming one of the few companies that are ready to take this risk.

The largest Chinese importers of liquefied gas (Sinopec and PetroChina) are even considering the possibility of additional supplies from Russia, receiving a discount of more than 10% against the background that other countries are trying to avoid purchasing energy resources from the aggressor country. Some importers also offer to buy liquefied gas on behalf of Russian companies. Thus, they want to hide the purchases from Western governments and partners, who may impose sanctions against China for helping Russia.

In addition to energy cooperation, Sino-Russian trade has expanded in recent years to include food and agriculture, new energy vehicles and other sectors.

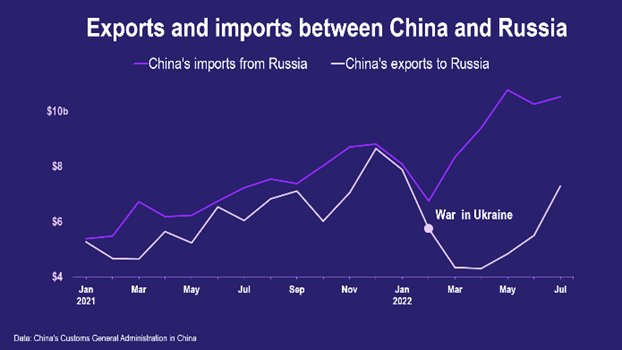

In terms of exports from China to Russia, Russia bought $6.7 billion worth of goods from China in July, more than a third more than the previous month and more than 20% more than a year ago.

At the same time, huge niches are being created for Chinese companies, which foreign companies are vacating on the Russian market. Thus, after Russia’s invasion of Ukraine, Chinese exports to Russia of microchips and other electronic components and raw materials, including those with a military purpose, increased, complicating the sanctions efforts of the United States and its allies.

According to Chinese customs, in the first five months of 2022, shipments of chips from China to Russia rose to about $50 million, more than doubling from a year earlier, while exports of other components such as printed circuit boards rose by double-digit percentages.

Exports of aluminium oxide, which is used to make aluminum metal, an important material in the weapons and aerospace industries, are 500 times higher than last year.

In March, Australia banned the export of aluminum oxide and several other related products because of their use in weapons development. Since then, China’s aluminum oxide exports to Russia have surged, reaching a record 153,000 metric tons in May, compared with 227 metric tons in the same month last year, according to Chinese customs data.

Russia’s isolation has also pushed vehicles made by Chinese companies such as Great Wall Motor and Geely Automobile Holdings into the ranks of the best-selling cars in Russia, with their market share more than doubling from last year.

The revival of demand for Chinese exports is playing out in the currency market. Trading volumes in the yuan-ruble pair increased to the highest ever last month as local demand for the Chinese currency surged. And settlement in local currency in trade between China and Russia also provides more “convenience” for traders between the two countries.

China is also gradually gaining leverage in relations with Russia. Although China has historically relied on Russia, and before that the Soviet Union, for many advanced technologies, this is now gradually changing as China closes the technology gap and becomes a defense exporter in its own right.

Researchers at the Washington-based nonprofit C4ADS studied trade between Russian defense firms and China Poly Group, a conglomerate controlled by China’s central government. Poly’s subsidiaries include a key Chinese arms manufacturer and exporter of small arms, missile technology and, more recently, anti-drone laser technology.

Between 2014 and January 2022, C4ADS identified 281 previously undisclosed consignments of so-called dual-use goods, from subsidiaries of Poly to Russian defense organizations.

In one of the latest shipments in late January, Poly Technologies sent antenna parts to the sanctioned Russian defense company Almaz-Antey, according to the investigation.

The Russian Almaz-Antey concern produces anti-aircraft missile and radar equipment for the Russian army, including the S-300, S-400, S-500, and has also been under sanctions since 2014.

Russian customs documents reviewed by C4ADS indicate that parts of the antenna are intended for use in radars that are part of Russia’s advanced S-400 anti-aircraft missile system. As is known, this S-400 system is used by Russia during the war in Ukraine.

In addition to radar components and semiconductors, Chinese exporters have also helped fill a gap in basic materials that Russia is prohibited from supplying from other countries.

In general, we can observe that since the beginning of this year, Chinese-Russian trade has maintained strong growth rates. Trade growth is a result of the high complementarity of economies between the two countries. And increasing sanctions from the West push Russia to expand exports to China and deepen comprehensive cooperation, which is directly of great interest to China.